It is crucial to understand the concepts of source of funds (SOF) and source of wealth (SOW) when dealing with customer due diligence in financial institutions.

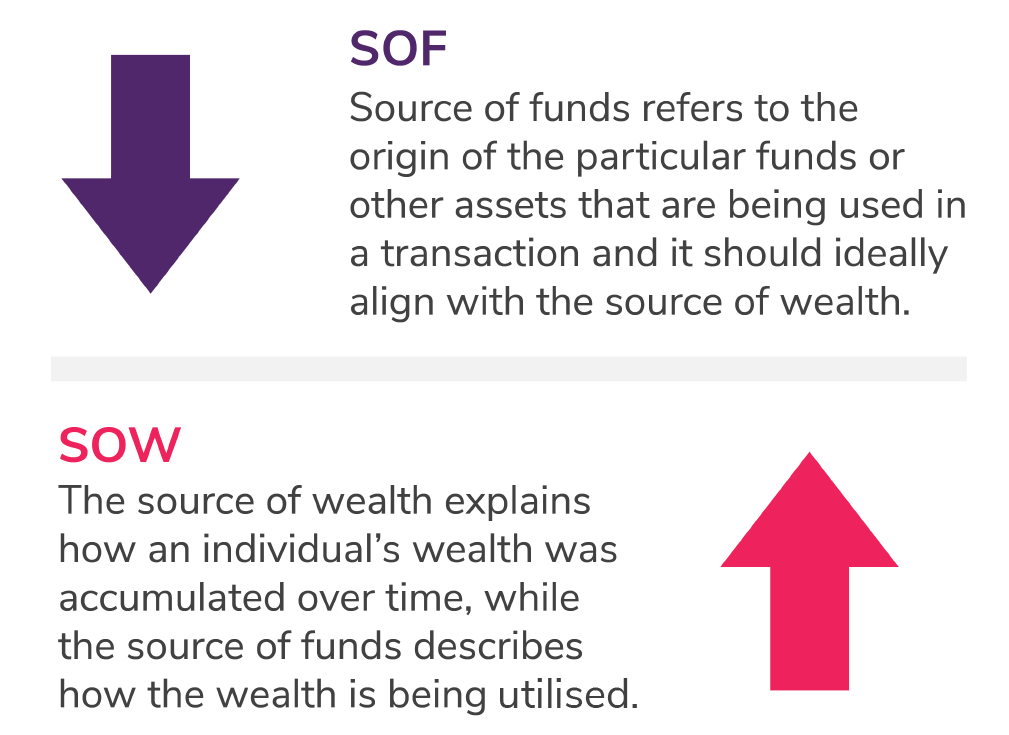

Source of funds refers to the origin of the money involved in a transaction, whereas source of wealth represents the entirety of a customer’s wealth, including assets and the activities that led to their accumulation. Both concepts are vital in preventing money laundering and terrorist financing risks, as they provide insight into the legitimacy of a customer’s financial activities.

AUSTRAC published new guidance in October, 2022 to help reporting entities identify and verify sources of funds and wealth as part of their know-your-customer (KYC) processes. The guidance aims to support entities in undertaking source of funds and source of wealth checks on customers and mitigate the risk that a customer’s funds relate to money laundering, terrorism financing (ML/TF) or other serious crimes.

The guidance highlights the importance of having appropriate risk-based procedures and understanding potential triggers for verifying collected information on the source of funds or source of wealth. Examples of such triggers could include the customer’s transactions or other activity being inconsistent with what the reporting entity knows about the customer.

There are vital reasons behind financial institutions prioritising the understanding of both source of funds and source of wealth. Here we examine five compelling points that emphasise the importance of this knowledge in mitigating risks and maintaining compliance.

1. Enhancing customer due diligence

Accurately identifying the source of funds and source of wealth allows financial institutions to perform more effective customer due diligence. This process helps institutions better understand their customers, assess potential risks, and make informed decisions about whether to establish or maintain a business relationship with a particular customer.

2. Preventing financial crime

Understanding the source of funds and source of wealth can help financial institutions identify and prevent money laundering and terrorist financing schemes. For example, knowing the origin of a customer’s wealth can reveal any possible connections to illegal activities, such as arms dealing or drug trafficking.

3. Ensuring operational efficiency

Having a clear understanding of the source of funds and source of wealth can help financial institutions streamline their risk assessment processes. This enables them to identify high-risk customers and transactions more efficiently, and allocate resources effectively to mitigate potential risks.

4. Regulatory compliance

AUSTRAC requires financial institutions to have risk-based systems and controls in place to identify the source of funds and source of wealth of their customers and their beneficial owners. By ensuring compliance with these rules, financial institutions can avoid hefty fines and penalties associated with non-compliance.

5. Preserving reputation

Financial institutions that fail to adequately identify the source of funds and source of wealth of their customers may inadvertently become part of illegal schemes, damaging their reputation in the process. By thoroughly understanding these concepts and implementing necessary controls, financial institutions can safeguard their brand image and maintain public trust.

In conclusion, understanding and implementing appropriate measures to identify the source of funds and source of wealth is crucial for financial institutions to mitigate money laundering and terrorist financing risks. By doing so, businesses can ensure regulatory compliance, prevent financial crime, protect their reputation, and maintain operational efficiency while strengthening customer due diligence efforts.

Want to learn more?

Fill in this form to talk to our friendly team today.