SYDNEY 08 Aug 2023: New research released today by credit bureau, illion, shows that a rise in overdue trade invoices and debt collection indicates that business conditions for Australians are likely to deteriorate through 2023. The ‘retail’, ‘food’, and ‘construction’ sectors are especially vulnerable.

With financial stress from falling revenues and rising costs impacting business solvency, business failure risk is trending higher, with little evidence of near-term relief.

Trade invoice data held by illion and analysed through its proprietary trade payment program, found that businesses operating in high-risk industries have the highest percentage of overdue trade payments (by dollar amount) and high-risk businesses are taking longer to pay outstanding invoices in 2023, as compared to previous years. Put in simple terms, their trade payment obligations are more likely to remain unpaid or substantially overdue when finally paid.

On a national basis, the ‘food services’ and ‘construction’ industries are showing the highest failure risk in Australia at 14 percent and 11 percent respectively, closely followed by the ‘retail services’ and ‘transport’ sectors, both at 10% risk of failure.

At the other end of the scale, ‘financial & insurance services’, as well as ‘professional & technical services’ both at 3.5 percent, and ‘wholesale trade & manufacturing’ at four percent having the lowest risk of business failure.

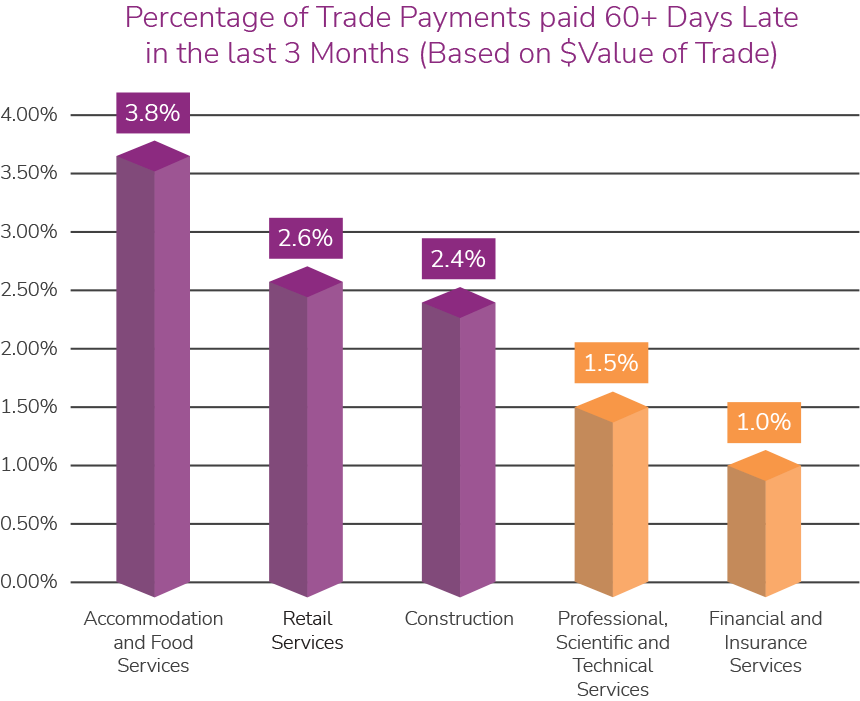

The following graph illustrates that trade obligations invoiced very recently (billed in the last three months) to businesses in the three higher-risk industries were far more likely to remain unpaid for at least two months than invoices due for payment from the lower-risk professional and financial services sectors.

This difference ranged from 60% higher, when comparing ‘construction’ to ‘professional services’, to three times higher, when comparing ‘food services’ to ‘financial services’. The food, retail, and construction sectors, therefore, appear to be the most vulnerable to financial stress such as from rising costs and lower sales.

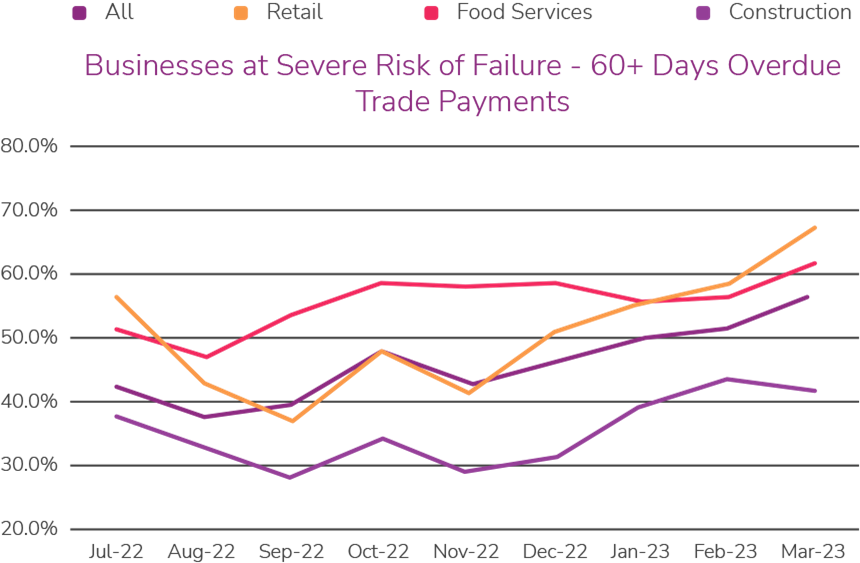

“When we focused on high-risk businesses, irrespective of their industry sector, the research found that 57 percent of all outstanding trade invoices were over 60 days overdue in March 2023, many times higher than the overdue rate across all Australian businesses, which is only around 6 percent,” said Barrett Hasseldine, Head of Modelling at illion. “Overdue trade obligations were therefore strongly indicative of business failure risk.”

“In addition, high risk businesses also suffered a large deterioration in overdue trade payments between July 2022 and March 2023, climbing from 42% to 57%. This deterioration in invoice payments was especially notable in the last quarter of 2022 and the first quarter of 2023, rising from 44% in November 2022 to 57% in March 2023.”

“With already-high underlying financial stress continuing to climb, and no indication of any improvement through 2023, Australia should expect to see overdue trade payments and higher business failure risk continuing through 2023.”

The research showed that the situation for high-risk businesses within the ‘food services’ and ‘retail sectors’ is particularly concerning, as shown in the below graph. In the food services industry, the percentage of substantially overdue trade payments now exceeds 62% (up from 52% in July 2022). In the retail sector it is now at 68% (up from a range of 40-50% during 2022).

“In both industries, high-risk businesses appear to have struggled for some time now but have also deteriorated substantially in the last 6 months,” Mr Hasseldine added.

“This trend in overdue payments suggests that the recent economic shock has had an especially significant impact on retail businesses, potentially resulting from falling revenues post-Christmas and rising input costs from shop rents, power prices, and inventory costs.”

“This recent rise in overdue trade payments can also be seen in vulnerable construction businesses, up from 29% in September 2022 to 42% in March 2023, and is likely to be attributed to the fall in cash flow from rising building supply costs and contract labour costs coinciding with fixed contracted project revenues.”

“The financial risks besetting the food services, retail and construction sectors have now also coincided with a significant rise in debt collection activity, most notably in the construction industry, which has seen a threefold rise in daily collections activity in Q1 2023, compared with the previous nine months.

“Similarly, the retail and food services sectors have had 75% rises in collections activity. This contrasts with the Professional Services and Financial Services sectors where we have seen no change in collections activity over the last 12 months.”

While Australian businesses have been affected by economic shocks in 2023, an underlying trend to higher failure risk has been evident for over 12 months. Vulnerable businesses have shown a gradual deterioration in their trading behaviour, which has then been exacerbated by these recent shocks.

-ENDS-

About the data

illion holds business information on over 8 million commercial entities and over 2 million active entities. Adverse business history, structural, geographic, demographic and director data is sourced from court registrations and ASIC. Trading behaviour, including invoicing and payment data is sourced from illion’s proprietary trade program, which holds the trading obligations of Australian businesses. The program’s data-store holds the volume and value of invoices received over more than 20 years and the business’ performance in meeting these obligations.

Disclaimer

“This Commercial Insights Report (“Report”) is provided by illion Australia Pty Limited (“illion”)as general information, and it is not (and does not contain any form of) professional, legal or financial advice.

illion makes no representations, warranties or guarantees that this Report is error-free, accurate or complete.

Want to learn more?

Fill in this form to talk to our friendly team today.