Non-individual customers can present a higher level of risk than individual customers.

Verifying the identity of the beneficial owners behind a complex business structure requires much greater due diligence.

One key obligation is to consider the various risks these beneficial owners may pose to your business and the Australian community.

The challenges behind non-individual customers

In a recent report on major banks, AUSTRAC assesses that non-individual customers pose a higher inherent money laundering and terrorism financing vulnerability because of the increased ability to obscure beneficial ownership, the source of funds or the purpose of transactions.[1]

Non-individual customers may have opaque and complex ownership structures, which makes it hard for banks and financial institutions to precisely know who they’re dealing with.

According to AUSTRAC, between 1 April 2018 and 31 March 2019, the exploitation of companies, trusts and other legal structures was identified in 40 per cent of money laundering-related intelligence reports involving major banks.

Trust accounts are widely identified as risk vehicles which require particular attention, as they can be used to store and move funds quickly and easily.

The difficulty in trading with trusts

Trust accounts are generally defined as a legal arrangement in which one party (the trustor or grantor) transfers ownership of assets to a person or bank (the trustee) to be held or used for the benefit of others.

Trusts and similar financial instruments have been a popular mechanism to minimise tax and protect assets since medieval times. They are now widely used in Australia as a vehicle for business, investment and estate planning. The ATO expects that by 2022, more than one million trusts will exist in Australia.[2]

While the majority of trusts are used for genuine business and family dealings, money laundering risks may also arise from trust and asset management activities, when customers and account beneficiaries deliberately create a degree of opacity in order to move illicit funds or avoid scrutiny.

What you need to do

Stringent documentation, verification, and monitoring procedures need to be established for accounts that are seen as higher risk.

Because there’s no registry of trusts and trust assets in Australia, identifying the trustees behind a business’s trust structure presents a major challenge. Companies must ensure they identify and verify not only the trust itself, but the relevant parties connected with the trust.

How illion can help

Non-individual customer uplift

Taking a strong data-driven approach, illion can rapidly perform a holistic portfolio overview assessment, identifying the areas of risk across multiple siloed legacy systems. This allows for a planned, risk-based approach for remediation to be undertaken.

illion will:

- Provide a detailed analytical profile of the customer base covering.

- Identify areas of risk for KYC remediation.

- Perform matching and verification of non–individual customers to relevant registries, including identification of directors and resolution of beneficial ownership.

Trust data uplift

illion also has the data, analytical expertise and industry knowledge needed to identify money laundering through trusts. Using our proprietary data and matching through our trust registry, we offer a unique trust database linking trusts to their corresponding trustees.

illion has data on:

- 471,000 trading trusts

- 415,000 marketable trust records (i.e. name, address and SIC)

- More than 400,000 trust linkages

illion’s trust registry works as a powerful indicator for customers who need to assess the accuracy of their own database, detect out-of-date information and implement remediation actions.

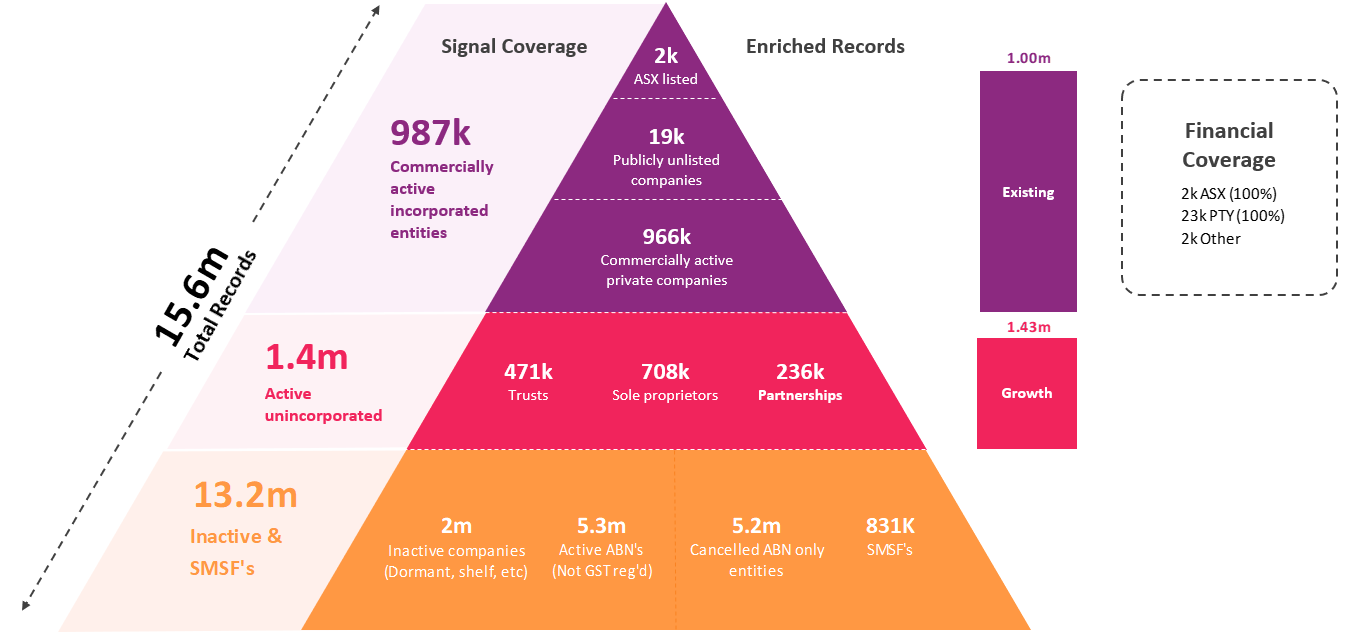

illion has the most complete view of commercial entities:

Want to learn more?

Fill in this form to talk to our friendly team today.