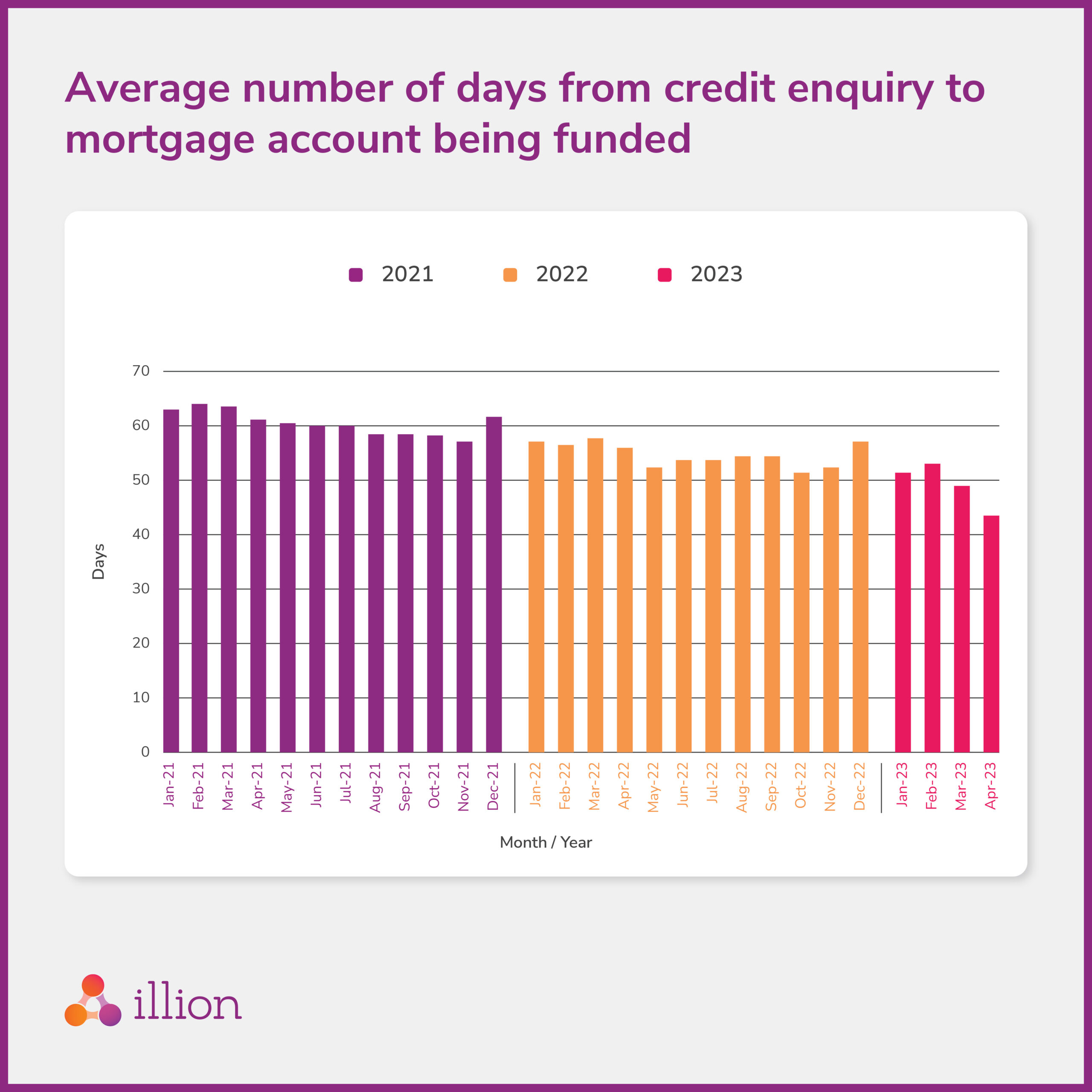

Many mortgage lenders have reduced the time it takes for consumers to get a new home loan or refinance.

In the last two years, there has been a steady decline in the time it takes from an initial enquiry to an account being funded.

While non-Big-4 lenders have traditionally been providing the fastest onboarding and approval processes on average, this gap has recently been closing.

Find out more in our Economic Snapshot.

Behind the Data: The who, what, where, when and why behind the data

Who: The analysis is compiled by illion Head of Analytics Louis Tsang, and illion Analytics Consultant Bharath Janarthanan.

What: This analysis combines illion’s unique credit enquiries data and accounts opening data, which illion obtains from comprehensive credit reporting data. Bharath matches and calculates the time between the credit enquiry to when the account is opened, to give a proxy of how long an application takes from start to finish.

Where: The focus is on Australian lenders, but similar trends have been observed in New Zealand.

When: These improving trends have been seen for some time now, as lenders across the board enhance their internal processes to provide a more streamlined service.

Why: We expect difficult times ahead. Consumers are always looking out for a better mortgage deal. A faster mortgage process means a better customer experience. Monitoring how your portfolio relates to the market can help you stay ahead of the competition.

Want to learn more?

Fill in this form to talk to our friendly team today.