As the threat of money laundering and terrorism financing in Australia and New Zealand continues to evolve, maintaining visibility and ensuring you have sufficient information about your customer portfolio is vital.

With recent AML (anti-money laundering) breaches from high-profile financial institutions, regulators are now becoming far more active in investigating AML compliance practices, targeting KYC (know your customer) obligations and putting pressure on compliance teams.

Being fully aware of what’s going on with your customers is the first step towards having a sound system – and protecting your company against illegal transactions.

Know your customers — and keep knowing them

In today’s rapidly changing world, the need to know your customer – and keep on knowing them – is more important than ever.

Even if you identified your customers correctly during onboarding, situations can change over time. You must continue to update your customers’ data and make sure you are proactively detecting high-risk situations.

Don’t wait for the regulator to come knocking!

We can help you keep your data clean and prevent the risk of financial penalties.

Taking a strong data-driven approach, we can move quickly to identify areas of risk, recommend actions to remediate your customer data and help you meet your AML/KYC obligations.

Take advantage of the most accurate data for individuals and non-individuals

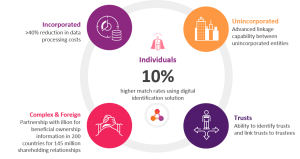

We can provide you with ongoing access to better match rates for individuals and a powerful commercial database with unique trust and unincorporated data.

Most accurate data for individuals and non-individuals

One cost-effective approach for all customer uplifts

illion can perform a holistic portfolio overview assessment to identify the areas of risk across multiple siloed legacy systems and allow for a planned, risk-based approach for remediation to be undertaken.

We will maximise customer data uplift by utilising the depth and breadth of illion’s most comprehensive data assets:

Verify or re-verify your client’s data and documentation against multiple sources using GreenID, illion’s market-lending electronic ID verification solution.

Perform matching and verification of non-individual customers against relevant registries, including identification of directors and resolution of beneficial ownership.

Identify high-risk entity types such as charities and money remitters and any other cash-intensive (elevated AML risk) businesses.

Screen all customers against extensive PEP and sanctions lists.

Where a data-driven approach is not possible, we can help collect and/or validate additional information using OCR technology, or via our illion Digital Tech Solutions company.

We can help you introduce ongoing customer monitoring to maintain customer databases in real time with our unique suite of AML solutions.

Want to learn more?

Fill in this form to talk to our friendly team today.