Fully utilising core bank transactional data can be challenging for banking institutions and risk management personnel looking to more effectively make risk decisions, ensure compliance and generate deeper analytical insights.

Harness illion’s industry-leading categorisation and decision metrics for richer core bank data analysis to achieve faster, smarter credit decisions or to display spend analysis for your customers in online banking.

Categorisation

Enrich your core data for smarter decisions

illion’s Categorisation provides superior transaction categorisation to enrich your institution’s core banking transactions while delivering intelligent analytical insights. Being armed with these valuable insights enables more accurate credit risk decisioning, hardship identification and management, and provides value-added spend insights in online banking.

How it works

Our categorisation algorithm makes it quick and easy for your institution to find the information you need for intelligent decisions – regardless of your data source. Simply send us your core banking transactions and we return the enriched data and insights to you.

Using a range of analytics techniques, our sophisticated categorisation and analytics enables identification of income, lending risk criteria and further spending habits, thus removing friction from the customer experience.

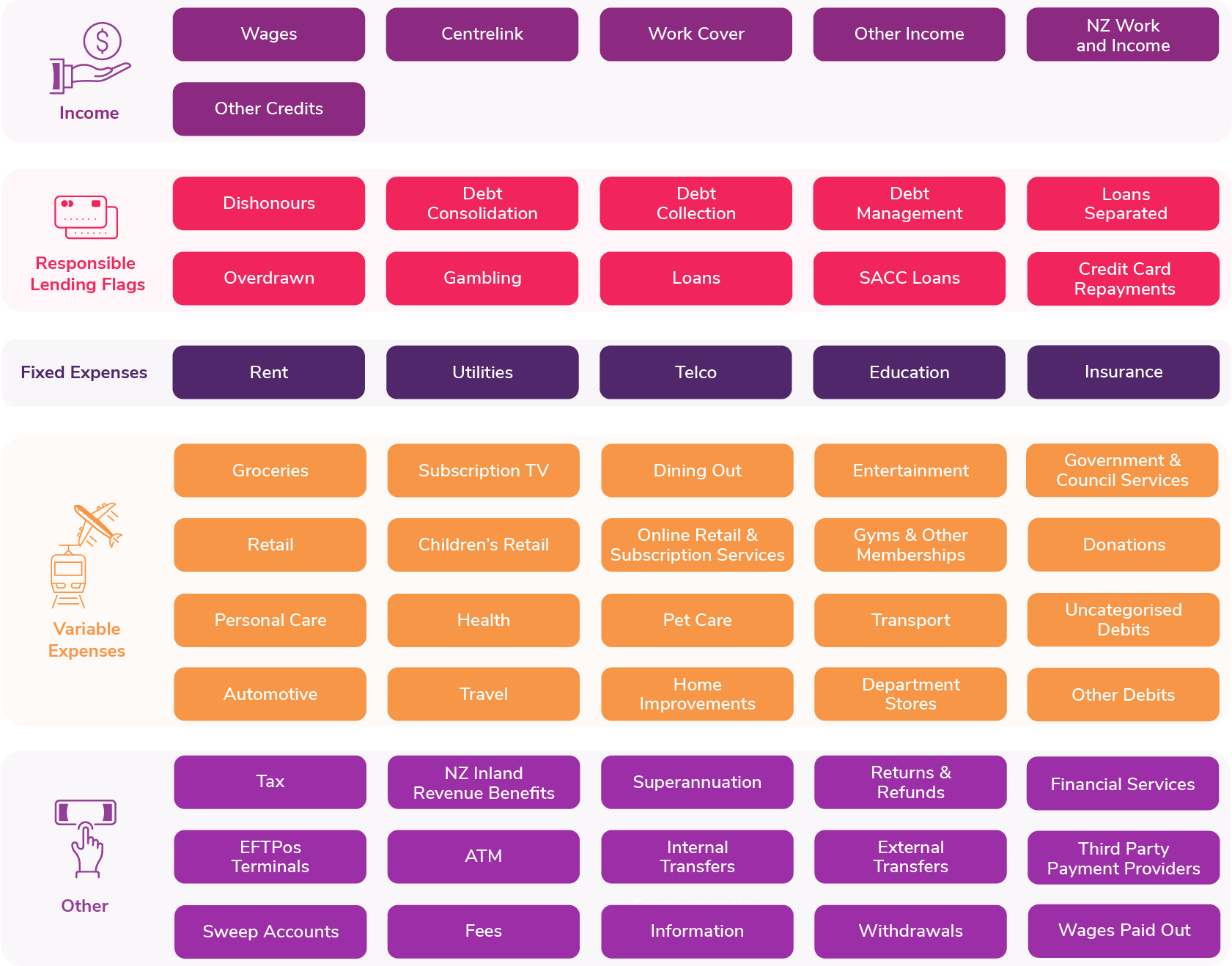

With 56 transaction categories and more than 220 pre-defined analytical decision metrics, you will have access to best practice models that allow you to benefit from insights on day one.

Our categorisation engine is constantly being refined to ensure we are providing the very best product in the market, these changes are made automatically.

Analytics techniques employed in our categorisation algorithm include:

• Linguistic analysis

• Vector space models

• Pattern (time-based and text) matching

• Keyword identification

• Machine learning

• Elastic search on commercial bureau – harness illion’s rich commercial bureau data for detailed information

illion Categorisation:

• Credit applications and decisioning

• Collections and hardship

• Online banking spend analysis (customer value-add)

• Budgeting and Personal Finance Management

Decision Metrics

A tailored view of core bank data

illion’s Decision Metrics can be used to more deeply assess the risk, liquidity and serviceability of your customers. Our metrics place the data you need at your fingertips for smarter lending decisions, driving your credit business further, faster. These metrics have been developed around customer requirements and, given our sizeable customer base, they’re considered to be best practice options.

How it works

Our data-driven decision metrics and pattern analysis utilise categorised transaction data to provide you with a tailored view of account holder information. The metrics are specific data points that can be customised based on your requirements.

Once your core banking transactions have been categorised, we run pattern analysis over the data, resulting in a series of intelligent data points that can be matched to your credit decisioning model

What are the data points?

Some examples of what is possible include:

Derive frequency and count of events

• Income frequency or count e.g. 5 per week

• ATM withdrawals on income payment days

• Number of small amount credit contract (SACC) dishonours

Perform calculations

• Gambling as a percentage of income

• Percentage of income spent on day of deposit

Combine multiple categories into one metric

• Living expenses i.e. a combination of rent, utilities, groceries, etc.

Identifying potentially risky transactions

• Customised flagging of high value transactions e.g. a listing of debits over $500

Text values

• Employer i.e. the transaction description of the wage provider

Date related metrics

• Expected pay date for largest income source

• Number of days since last Centrelink payment